6.10.13

The Bull Preachings

China’s Economy, Back on Track

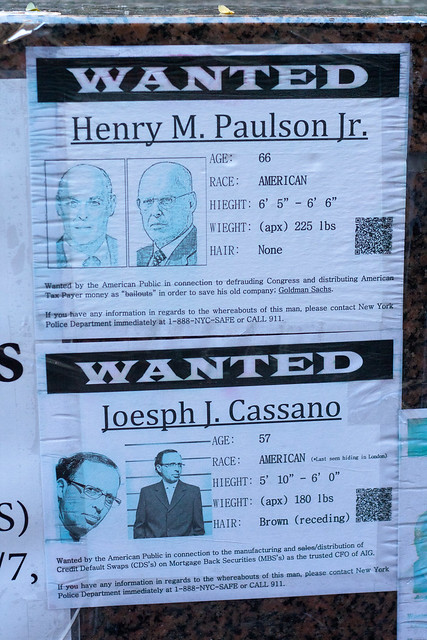

By HENRY M. PAULSON Jr.

CHICAGO — NEXT month, President Xi Jinping and Prime Minister Li Keqiang will use an important meeting — the so-called Third Plenum of the Communist Party’s 18th National Congress — to unveil China’s priorities for reforming economic policy for the next decade.

Yet because it will probably decide only general policies, leaving the specifics for later, some cynics have already begun to dismiss the reforms as too little, too timid and too late. They note that a decade ago, a previous generation of leaders failed to reduce the influence of state-owned enterprises and to complete the economic reforms of the 1990s.

But I believe the prospects for restructuring China’s economy — bolstering the role of the market, expanding opportunities for small and medium-size businesses, allocating capital more efficiently and improving the balance between consumption and investment — are better than at any point since the 1990s. At a time when global growth remains sluggish, reinvigorating such reforms is more important than ever to the world economy.

There are four reasons for my optimism.

First, China’s leaders clearly understand that their growth model needs to change.

In speech after speech, Mr. Xi and Mr. Li have put their political capital on the line by promoting economic reform. They have drawn up blueprints and adopted pilot programs — like a free-trade zone in Shanghai — that will bolster the market and rationalize the allocation of capital, for instance by permitting more foreign competition and greater fluctuation of interest rates.

Other reforms, including liberalizing deposit rates, still need to be put in place, but an experiment to liberalize lending rates is a very positive step. So is Beijing’s signal that it might open more sectors of its economy to competition through a bilateral investment treaty with the United States.

Second, China’s new leaders are strong enough to press for change. The history of Chinese economic reform suggests that vigorous central leadership is essential. Deng Xiaoping was the determined architect behind China’s initial reforms in 1978 and their reinvigoration in 1992. Zhu Rongji, the prime minister under President Jiang Zemin, pushed through reforms of the taxation system and state-controlled industries that paved the way for China’s joining the World Trade Organization in 2001.

But in the decade or so since then, reforms stalled, and a major cause was the evaporation of political commitment in Beijing. The new leaders have signaled that they are prepared to move. An anti-corruption campaign begun by Mr. Xi demonstrates a willingness to take on even the most politically sensitive pillars of the state-led economy.

Third, China no longer has the luxury to delay needed reforms. China’s economic output expanded nearly sixfold between 2002 and 2012, from $1.5 trillion to $8.3 trillion, but that growth fostered complacency. True, it weathered the financial crisis through giant spending on public works, but that only put off the day of reckoning. The presumption that China can simply grow its way out of any problems no longer holds. Growth is slowing, inequality has widened, provincial and local government debts have climbed. China’s export-oriented sectors face harsh headwinds, from sluggish consumer demand in advanced markets to rising labor costs at home.

Fourth, public expectations for change are higher than ever. When the new leaders were appointed last year, they were compared favorably to their immediate predecessors, President Hu Jintao and Prime Minister Wen Jiabao. But the honeymoon for Mr. Xi and Mr. Li, who took over last November, is over.

Increasingly, they are being measured against the bold Mr. Jiang, the Communist Party leader from 1989 to 2002, and Mr. Zhu, the prime minister from 1998 to 2003. And so the necessity for action is greater.

Momentum is building for reforms that would introduce market prices for oil, gas and other natural resources so that prices better reflect supply and demand, rather than official fiat. Distorted pricing has been one cause of China’s energy inefficiency and environmental degradation. Like the new steps toward liberalizing energy prices, Shanghai’s new free-trade zone is another positive indicator. More is needed — broader access to capital, greater investment options and protections from the risk of haphazard capital flows — if Shanghai is to become a global financial center.

A new round of fiscal reforms is also likely, leading to more rational allocation of resources between the central and local governments, which are struggling to rebuild weakened rural pension and health care systems and manage the largest urbanization in human history in a sustainable way, while paying for unfunded mandates from Beijing and maintaining job growth.

This vast array of specific reforms can’t be achieved at a stroke, and certainly not at a single party gathering. But the decisions likely to be taken in November will set China’s economy in a positive — and lasting — new direction. Advanced economies, like the United States and the European Union, depend on it as much as China does.

Henry M. Paulson Jr., the secretary of the Treasury from 2006 to 2009 and a former chairman and chief executive of Goldman Sachs, is chairman of the Paulson Institute, which promotes sustainable growth and a cleaner environment in the United States and China.

Mark Thomason Clawson, MI

"if Shanghai is to become a global financial center" on the scale of China in the world, the second largest economy, that will be tremendous competition for the existing financial centers.

This must have a special appeal to China, and many others, because NYC and London and the Eurozone have failed so badly in the financial crisis they committed and have not cleaned up.

This could have important effects, forcing a clean up of existing financial centers that have been taking for granted and abusing their market power.

Bob North Bend, WA

Paulson is the same guy who said USA economy was in the best shape ever, back in 2007. Right now, about China, he might be right, he might be wrong. Problem is, he has no credibility. He's already shown himself to be a panderer. So, I say, go pander somewhere else -- 'cause I ain't listenin'.

Nathan an Expat China

Nice to see an analysis of China in the NYT that does not position the country as an as some sort of dystopian nightmare and/or emerging military threat. China's leaders' greatest challenge is a population of almost 1.4 billion split almost evenly between groups living in 19th, 20th and 21st Century conditions and mindsets. (The 20th and 21st century group accounts for the country's 600 million Internet users.) It's a challenge similar to what the US would face if Washington was suddenly made legislative capital of not just the US but all of Central and South America and the Caribbean and had to directly govern that developmentally diverse a population. Over the past 30 years China has done a pretty good job lifting 300 million out of poverty and investing heavily in education and infrastructure. Almost everyone in the country is on an upward trajectory economically. Not since the Tang Dynasty have things looked so good for so many. But as Paulson notes the time has come for China to change its unsustainable investment led growth economic model and focus on sustainable growth derived from domestic consumption. Again good news for the average Chinese who will be seeing increased investment in social spending/medical care to help them unlock their wallets. The major foreign policy issue rising China faces is managing their relationship with an increasingly prickly, stagnating or in decline America whose frustrated population all too ready to blame China for its problems.

JE White Plains, NY

Paulson the Wall Street banker who under Bush Jr. as treasury secretary helped his friends on Wall Street raid the government's treasury in broad daylight is now urging China to "liberalize" (open up to the "free market" casino) it's economy!?

Our own country to this day is still suffering from the Wall Street manufactured crisis in 2008 and hasn't recovered. Those bailouts and the continued massive money printing under QE have only kicked the can down the road, and is setting this country up for a much worse financial disaster and hyperinflation.

We need Glass-Steagall to be reinstated via Marcy Kaptur's bill in Congress and John McCain's and Elizabeth Warren's bill in the Senate to shut down the trillions derivatives and other toxic financial instrument, to cancel this bad, illegitimate debt off the government's books, otherwise, not only will our economy keep disintegrating but so will China's as well as the rest of the world.

Nelson Alexander New York

This is almost bizarre. Minus the almost.

Just prior to the financial meltdown in 2007, Paulson was insisting that the Chinese "open up" and adopt our own financial models. Then, stuff happened.

In our own system, the taxpayers were forced, by Paulson et al., to hand billions over to the bankers. Presumably, this is the "free market" system Paulson wanted and still wants China to adopt.

In our own "free market" system, the banks can basically use the state to transfer taxes to themselves whenever they wish...or whenever they declare a "crisis."

Is this the system China should adopt?

Obviously, Pauslon et al., want to "invest in China." Which has a massive, unprotected labor supply...the source of value. Why wouldn't they?

They can even promise the Chinese, their lives will get "better." (As long as American live get "worse.")

As a typical Marxist, I agree that American lives should, must, and will get worse. So be it. But I hate the hypocrisy (or stupidity) of these antiquated capitalist rationalizations.

Paulson, I always thought, is probably a decent man. But he seems to have learned nothing. He needs to read much, much more history and philosophy before he opens his mouth again.

CSW New York City

"The presumption that China can simply grow its way out of any problems no longer holds. Growth is slowing, inequality has widened, provincial and local government debts have climbed. China’s export-oriented sectors face harsh headwinds, from sluggish consumer demand in advanced markets to rising labor costs at home."

Hey, this sounds like a description of the US economy as commandeered, for the past thirty years, by the neo-conservative/liberal crowd starting on January 20th, 1981. Perhaps they can pivot towards Asia and thus give China and other countries (through the TPP agreement) the same advise they gave our presidents. They can prove Einstein's adage wrong by recommending the same strategies but insisting on different outcomes.

Otto Winter Park, Florida

"An anti-corruption campaign begun by Mr. Xi demonstrates a willingness to take on even the most politically sensitive pillars of the state-led economy."

I would like to hope that this is true. However, in the past, "anti-corruption campaigns" have amounted to nothing more than one faction using its superior clout to crush an opposing faction. Since all of China's prominent families are embedded in the nation's major industries in a way that most observers would regard as inherently corrupting, it is difficult to see how any anti-corruption campaigns can be effective at this point.

FEDUP Sunshine State

With an economic power house engine, a government that has the ability to make decisions to direct growth and urbanization, a currency that will soon be acceptable worldwide for international trade and no debt....China is well on its way to become the biggest super power in the world.

Too bad our errant leaders are consumed with war mongering, failure to change ineffective policy, failure to govern fiscally, failure to address severe inequality and failure to help Americans. The American ship is sinking faster than most think.

China is going to pass America as America sinks.

burghardt New York, New York

WIth all due respect, I believe it was the same Mr. Paulson who said in 2007 that, "This is far and away the strongest global economy I've seen in my business lifetime."

Meanwhile, China charters cautiously on her own:

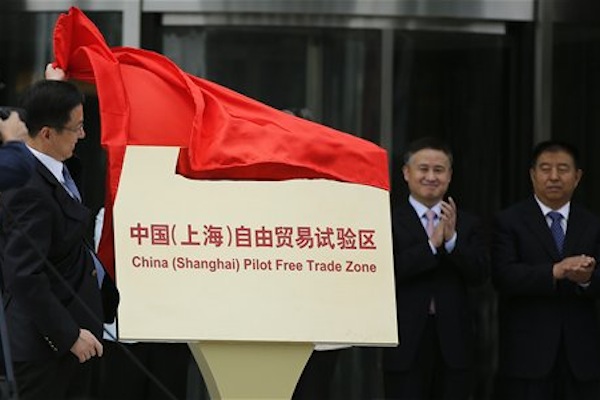

Experimental Free-Trade Zone Opens in Shanghai

By DAVID BARBOZA

SHANGHAI — China opened a new type of free-trade zone here on Sunday in a bid to test financial changes that the government said could eventually spread to other parts of the country.

The new zone, which has the backing of the State Council, the Chinese cabinet, was first announced last July. It is expected to allow banks and other businesses within its boundaries to experiment in areas that are tightly controlled in China, including loosening regulation of interest rates and full convertibility of nation’s currency, the renminbi.

By opening the new test zone in Shanghai, a city of 20 million and one of the country’s major financial centers, the government appears to be signaling its determination to ease restrictions on investment while also trying to press ahead with plans to open up its financial system and internationalize its currency, analysts say.

The government has not yet given a detailed outline of how the pilot zone — which covers 29 square kilometers, or about 11 square miles, of ports and logistics areas — is expected to operate. But on Friday, the State Council said foreign and private companies would soon be allowed to invest freely in banks, shipping ventures, travel agencies and health and medical insurers that are set up in the experimental zone.

Restrictions are also being lifted on foreign investment in some telecommunications services and on the production and sale of video game consoles.

The creation of a free-trade zone in Shanghai comes as China’s new leaders try to grapple with how to restructure a fast-growing economy that favors state-run enterprises and restricts foreign investment and the free flow of capital.

The value of real estate in the area near the experimental zone has shot up in recent months, along with the share prices of publicly listed companies operating in or around the zone. But the leaders of multinational corporations have been pressing the government for more details, and it remains unclear how it will interact with other parts of China.

“There’s a lot of interest, but few people know the details yet,” said Stephen Green, a Hong Kong-based economist at Standard Chartered Bank.

But Yao Wei, a Hong Kong-based economist at Société Générale, said in a report this week that the signs were encouraging, and that creating the zone was reminiscent of the bold experiments China made in the previous decades.

“The overarching theme of all the reform in the 1980s and 1990s was, simply put, liberalization,” Ms. Yao wrote. “Local experiments in strategically important cities not only served as policy signals of reform commitment but provided guidance as to the path of upcoming changes.”

Subscribe to:

Comments (Atom)